Dad2three

Gold Member

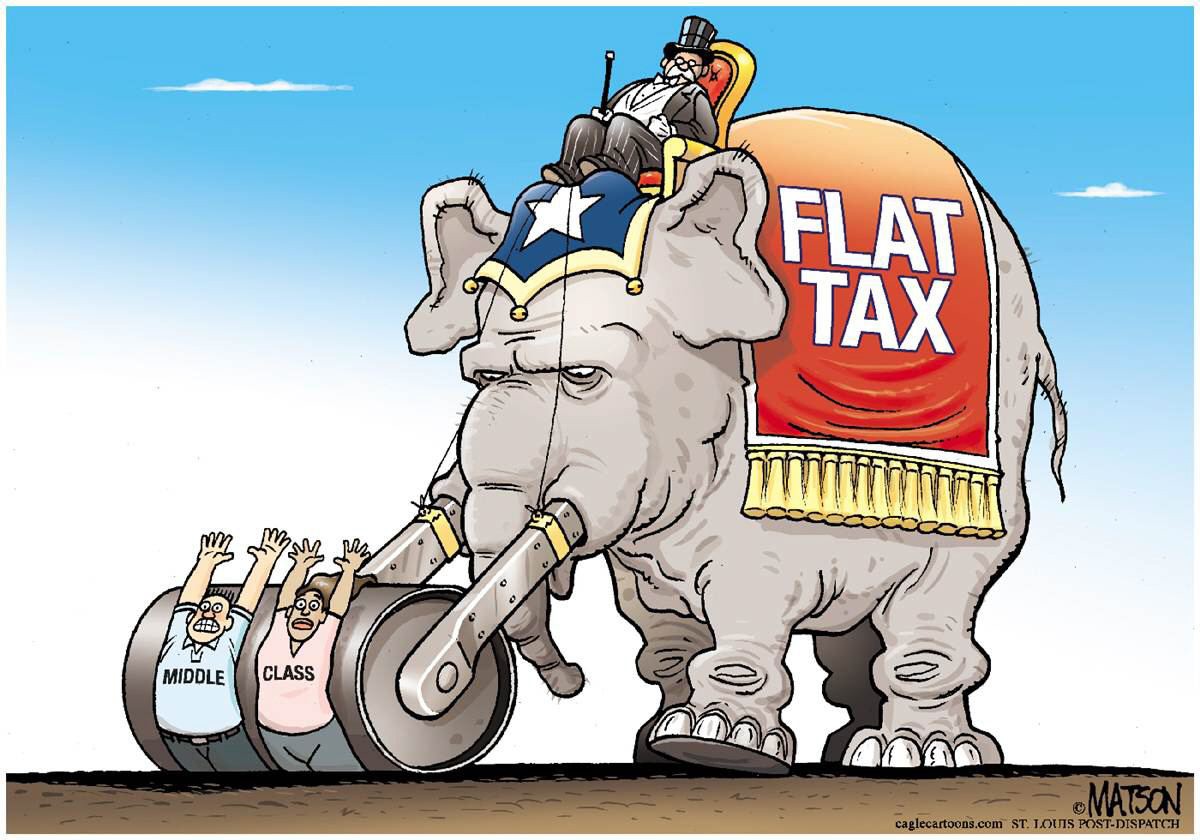

I think the rich should ABSOLUTELY pay more because the majority of them are selfish and don't care about anybody but themselves! Trust me, if you are a millionaire, it is NOT going to hurt you if you just pay a little more in taxes. I believe that if you are a good and righteous person, you would want to help the poor or people that are less fortunate. It's as simple as that! People need to stop being so selfish.

80% of all federal gov't revenue is derived from personal income taxes. The top 10% of American earners carry 70% of the tax load. The top 25% of all earners carry 86% of the load. What would satisfy you? 96%? 106%?

Oh ... and the bottom 49% of all earners pay NO FEDERAL INCOME TAX.

You get a free ride on the backs of everyone else.

Quit your whining and start earning.

MORE right wing garbage based on garbage. Shocking, the bottom 50% of US make about 11% of ALL US income, about the same as the top 1/10th of 1% make

Historical Amount of Revenue by Source

Historical Amount of Revenue by Source

I PROVED YOU ARE A LIAR, RUN AWAY BUBBA

Uh, the PAYROLL TAX is a TAX ON PERSONAL INCOME, bub.

MORE right wing noise. Since when is income tax capped after a certain amount like SS? Hint neither SS or the OTHER INSURANCE programs (Medicare) is income taxes! Yes, it IS a tax ON income!