Dad2three

Gold Member

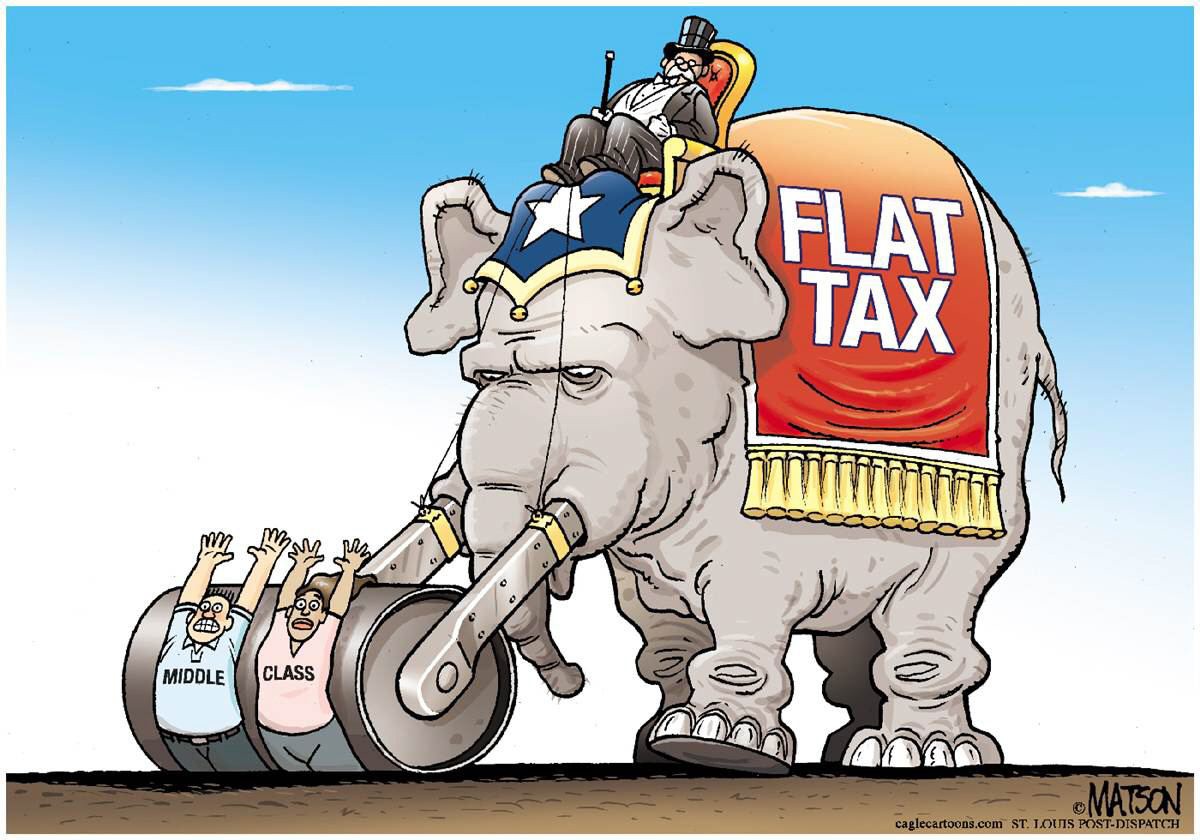

From: 10 Tax Questions the Candidates Don t Want You to Ask - 2 What the Flat Tax Taxes

Question. Incidentally, many, and perhaps most, Americans believe that a single, flat tax rate would be fairer than our system of progressive rates. So, you might ask, who would pay more income taxes, and who would pay less, if the only change to our income tax system were the adoption of a single, flat tax rate today that would generate as much revenue as is generated by our progressive rates? The single tax rate would have to be about 19% in a typical year.

Answer: Middle-income taxpayers would, on average, pay considerably more, and high-income taxpayers would pay considerably less. For people with taxable income in the $50,000 -$75,000, the tax rate on that income is, on average, about 13%. For people with between $2 million and $10 million of taxable income, the tax rate on that income is, on average, about 26%, nothwithstanding favorable tax rates on dividends and capital gains.

So if you’re in the solid middle class, your tax rate would be about 6 percentage points higher with a flat tax rate, while very high income households would enjoy a tax rate about 6 to 7 percentage points lower. Now what do you think?

Bullshit...10% of a million is more tha 10% of 100,000 so the millionaire automatically pays more to the government than the guy making 100,000 ....so sorry, your bullshit doesn't fly....a flat tax is the only fair way to tax people if you aren't filled with hate and envy of someone who makes more money than you...and that is at the core of the left...hate, jealousy, greed and envy...

Weird how SOOOOO many people here talk about "hate" and then show how it's REALLY done

80% of the population owns 5% of the wealth.

Who Rules America Wealth Income and Power

The middle class has been eviscerated. What middle class?

the middle class gets screwed by the politicians spending 18 trillion dollars, which eats up the money that could be used to create jobs......the politicians you want to give even more money to are the ones fucking up the economy...so why do you want to give them more money.......?

you said they just give that money to the rich right, dumb fuck? so why on earth would you want to give them more tax money...our money, so they can just give it to the rich? Please...explain how that works.....

DUMBFUK, MOST OF THAT $18 TRILLION CAN BE TRACED BACK TO RONNIE/DUBYA TAX CUTS !!!