eagle1462010

Diamond Member

- May 17, 2013

- 69,330

- 34,358

- 2,290

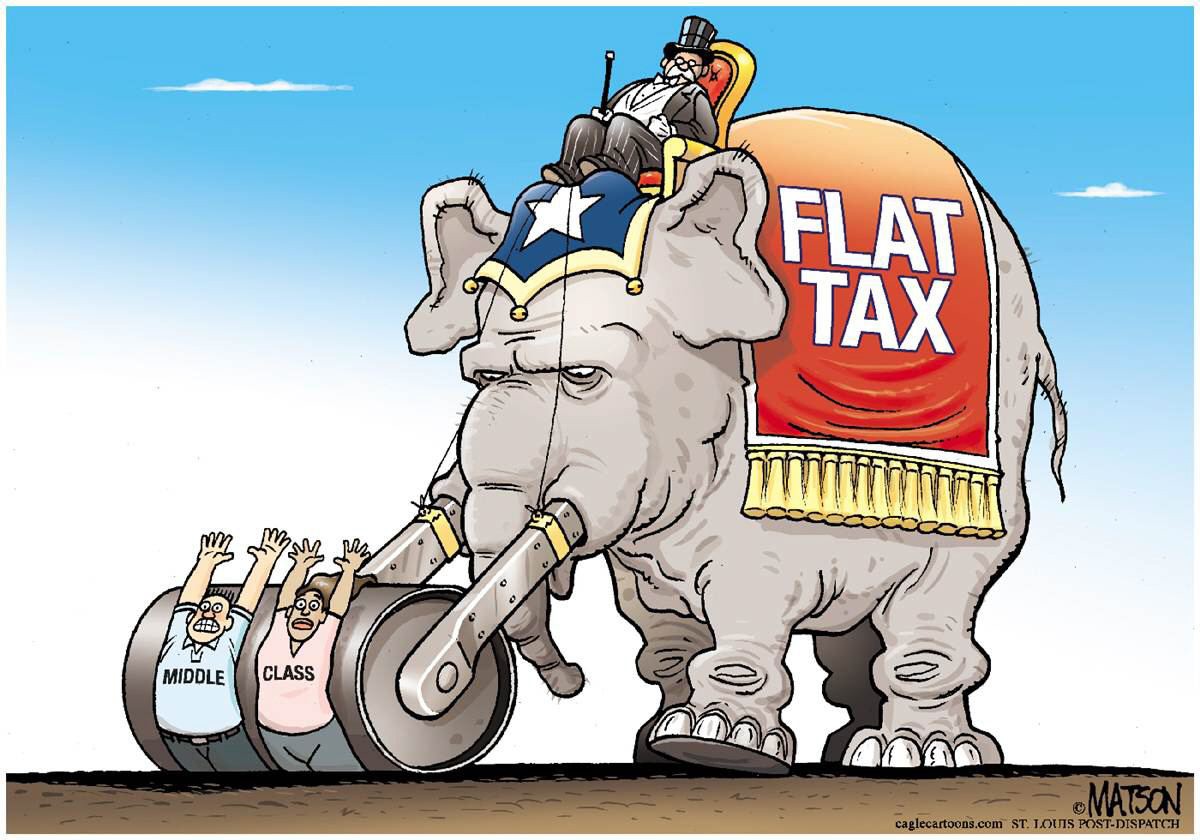

I have done so before and did an analysis for the year 2012..........and the rate was 15% that I calculated to get a return on the system at 200 billion more than under the current system of taxation.BS...........the effective rates under the current system are far lower than the percentages of tax rates...........The massive tax codes have ensured that.....................The massive code is for loop holes and twisting of tax law to keep people from paying the rates and nothing more.Except anyone who understands basic math knows how much revenue would be lost, social programs would be mercilessly gutted.Progressive taxation and crack down on loop holes, like every other country.I've already stated that earlier in the thread..................They pay taxes on property, sales tax, and etc.............

Like the Gasoline tax to pay for our roads.................as another poster has already stated as well.

The simplified code ends the BS under the current system. It is too large for a reason............because the lobbies want the loop holes to avoid paying already. The flat tax would end those loop holes.............and make paying taxes simple...............

Exactly HOW IS THAT BAD.......Unless you think 0% isn't enough already under the Federal Tax rates.............and want to maintain a 200 BIllion a year Welfare system under the tax code without really calling it that..................

No, a flat tax with a 50 thousand dollar exemption for all people or a national sales tax are the two fairest ways to generate tax revenue. anything else is based in hate and greed.

Instead of repeating right wing talking points, how about a CREDIBLE link to ANY flat tax plan that would work, and run Gov't? lol

It was based off the IRS data for that year and the wage brackets directly from the IRS..............

It fell on deaf and dumb ears...........aka YOU...............who refuse to even consider it...........because you like the current BS system which is corrupt with fraud.

But liking fraud and abuse is expected of you.