jc456

Diamond Member

- Dec 18, 2013

- 139,218

- 29,148

- 2,180

where? didn't happen in Illinois. my property taxes went up last year and there was no tax cut? what the fk are you talking about?When federal aid goes down, local and State taxes and fees go up. You wawa a diagram, brainwashed functional moron?how does the federal taxes change the local taxes? that's local politicians who need to adjust. it's not my job to take care of every school district in the country. I pay my property taxes locally so do all the land owners. that pays for local services, not federal dollars. what the fk is wrong with you. you didn't answer the question. how does cutting the taxes on the 1% hurt the 47%. you told my how local officials don't care about their people. now answer my question.When you cut taxes on the rich federally, state and local taxes and fees go up to makeup for lower federal Aid, and that kills the non rich, along with all the cuts in services like cheap education and Training and all the other things all other modern countries have... Healthcare daycare infrastructure vacations and on and on, stupid. We now have a flat tax system, and are becoming a GOP Banana Republic. Great job scumbag GOP and silly Dupes like you. Read it Chump.so how does cutting taxes on the 1%ers hurt the 47% who don't pay taxes. you still haven't answered.Ah the truth hurts.Nice but uncalled for cheapshot at the military, you can probably guess my response. Which is 2 words, 7 letters, 1st word starts with an "F" and the 2nd one starts with a "Y".. There's a website called Grammarly.com that checks your spelling and grammar; dude, you really need it.

As for willing to be educated, I highly doubt that. I really don't understand much of whatever your point is that you're trying to make.

Again, someone whined 47 % don't pay taxes.

I asked how many are trumpies?

That's all.

And btw I spent my childhood in air raid shelters getting the crap bombed out of me and seeing dead everywhere

You?

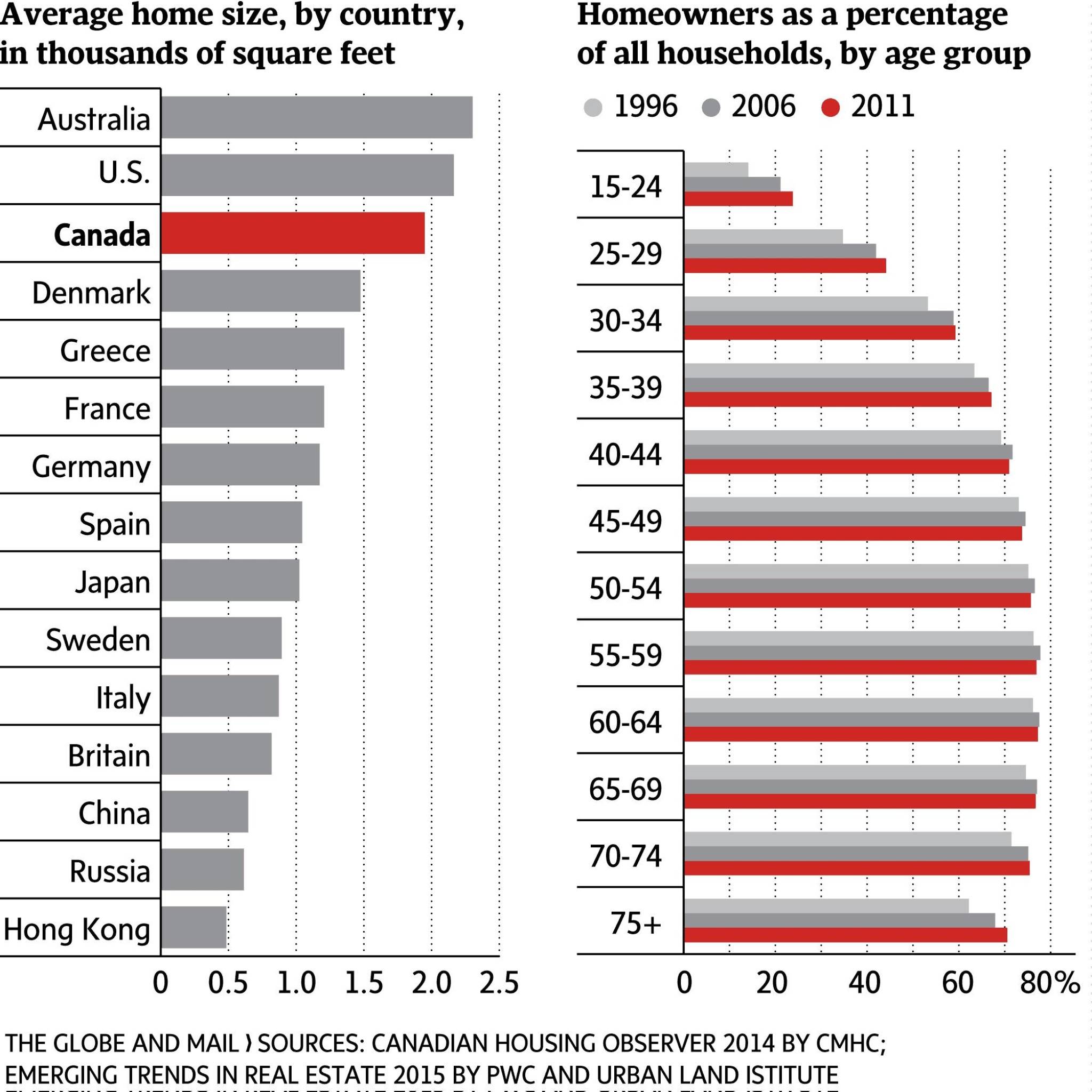

one tax graph you really need to know - The Washington Post

Washington Post › wonk › 2012/09/19

View attachment 196076

Sep 19, 2012 · At the heart of the debate over "the 47 percent" is an awful abuse of tax data. This entire conversation is the result of a ...

Last edited: