BrokeLoser

Diamond Member

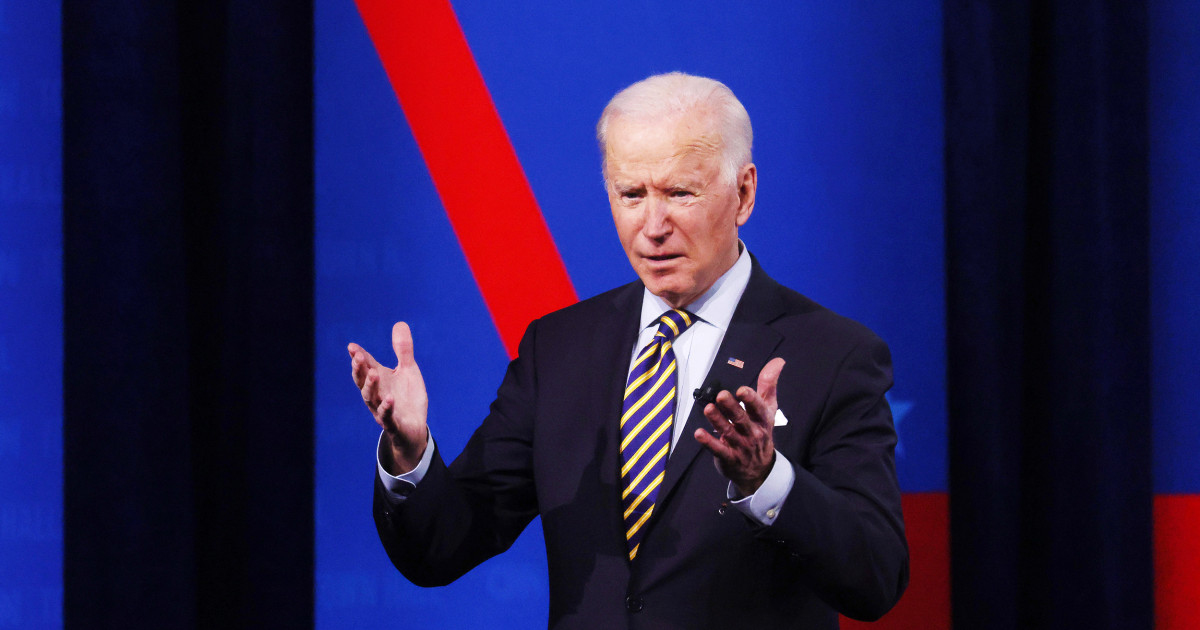

What do you all think of Bidens answer to this question?

Biden on forgiving student loan debt

“Forgiving” is such a FEEL good word.

How is he “FORGIVING” this debt?

What’s behind this forgiveness?

Explain the workings of how this debt is forgiven?

Forgiving a debt is an actual term that is used in economics. Not snowflake emo spin. Nice try at a twisting the topic but how about you answer the question in the OP before expecting me to answer your questions?

I refuse to logon to twitter and I refuse to watch or listen to the Almost Dead Dude speak....what exactly did he say?