frigidweirdo

Diamond Member

- Mar 7, 2014

- 46,228

- 9,791

- 2,030

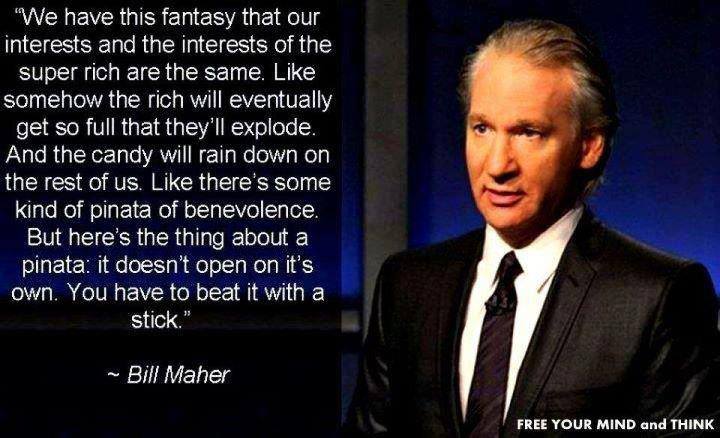

Yes.............

To whom more is given, more is required............

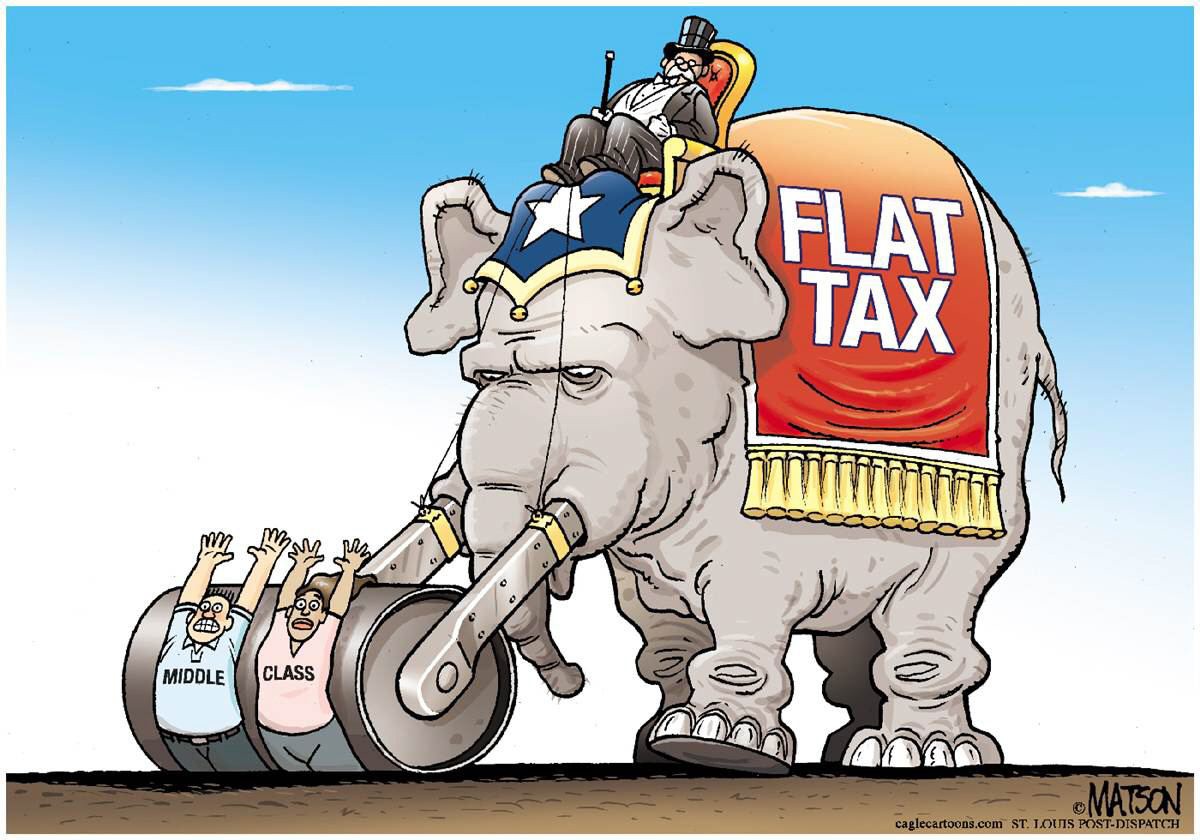

And indeed the top 25% of America's earners currently carry 86% of the federal personal income tax load while the bottom 49% get a free ride.

So how much of the load should the top earners carry?

96%?

106%?

But this avoids the fact that the top 25% of Americans probably use about 90% or more of the usage of government services.

Are they paying their way? Probably not.

Just showing statistics about how much someone pays doesn't mean that they're paying too much.

you cant begin to prove that idiot; but making a fool of yourself doesnt seem to bother you. prove the "fact that the top 25% ...use 90% more of government services"

Oh, great, an insult. Well done. Bye.

you didnt have to focus on my insult; you could have just backed up what you posted with something resembling a fact and stuff.....................

No, I didn't need to focus on your insult. However you didn't need to insult. As it is you insulted someone with a policy of ignoring people who insult because, quite frankly, if you need to insult it means you're not worth talking to in the first place.

So, again, BYE.