Dad2three

Gold Member

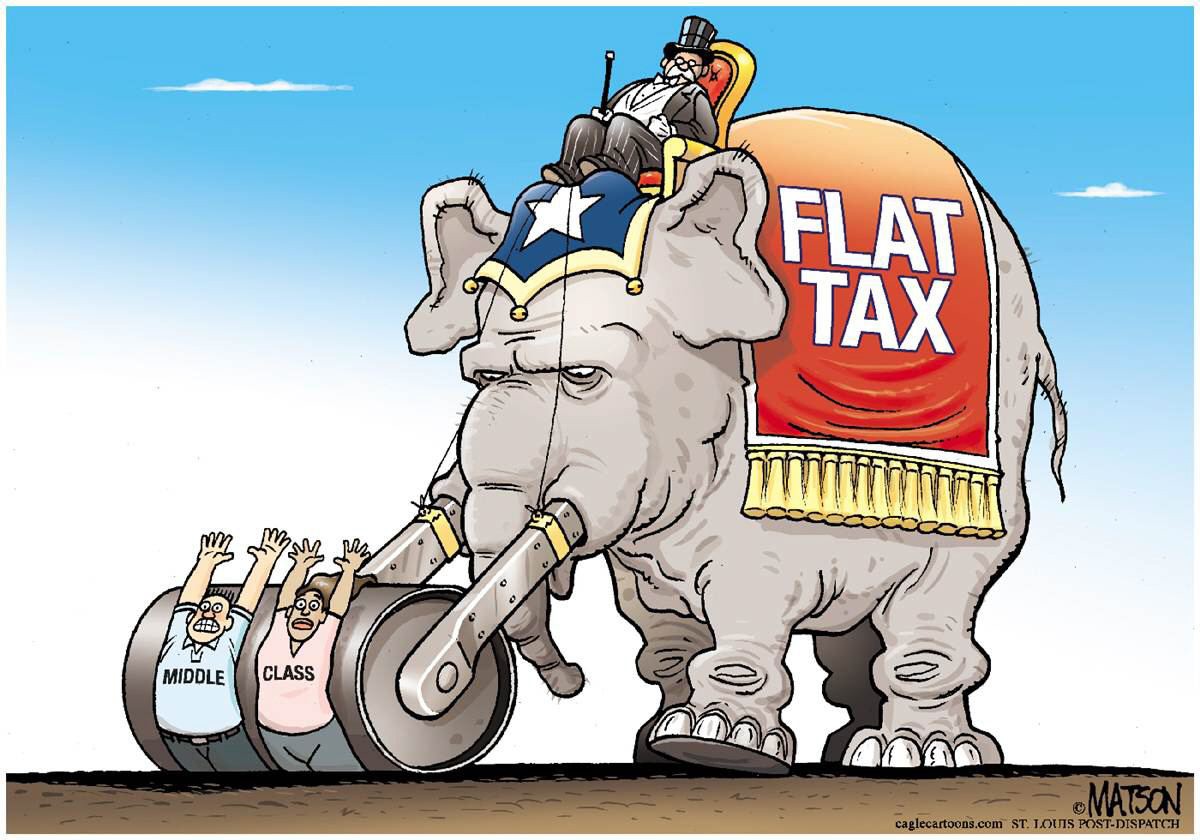

Because the rich write the laws for the rich. That is why Buffett wants taxes raised, he knows it will be earned income that is taxed not his unearned, which the rich usually make more at.

Warren Buffett: U.S. Never Followed Through On That Whole 'Tax The Rich' Thing

Warren Buffett thinks it's a problem that some of the wealthiest Americans pay lower tax rates than their housekeepers.

The billionaire investor said taxes on the wealthiest Americans are far too low, given that some of the 400 largest earners in the United States, whose average income was about $200 million a year, pay a tax rate of less than 10 percent.

“That’s still a lot less than my cleaning lady,” Buffett said in an interview with Politico editor-in-chief John Harris. “So it hasn’t been fully corrected,” he added, referring to the fact that he has been complaining about this issue for years.

Buffett said his own tax rate was “certainly not too high.”

The 84-year-old “Oracle of Omaha” -- a nickname the Nebraska native earned for his track record of lucratively accurate investment predictions -- has long advocated for a minimum tax on top earners. In 2011, he wrote an op-ed in the New York Times calling on Congress to raise taxes on households earning more than $1 million a year. President Obama embraced the idea, calling it "The Buffett Rule."

Specifically, Buffett urged the federal government to charge higher tax rates on income earned from some stock dividends and capital gains. Currently, such income is taxed at rates far lower than ordinary income

Warren Buffett U.S. Never Followed Through On That Whole Tax The Rich Thing

GET INFORMED, OR STOP USING RIGHT WING TALKING POINTS BUBBA!

I know what he wants. He wants higher earned income taxes with less deductions. He never talks about unearned income, which is most of his income.

Are you a fukkn moron or what? Plain English NEVER seems to get thru that tiny brain of yours on ANYTHING. You are typical right wing hate talk radio listener who believes the propaganda spewed by the morons!

.

Specifically, Buffett urged the federal government to charge higher tax rates on income earned from some stock dividends and capital gains. Currently, such income is taxed at rates far lower than ordinary income

I know name calling is generally ineffective. First it shows weakness and secondly it tends to shut down the communication between two people. Of course, some people like to name call because they don't want ideas exchanged or challenged.

And clearly D2Three is here to spew baseless socialist BS and when exposed, to pepper his betters with invective. Nearly 10,000 posts in little more than a year with months off for bad behavior. Having perused a couple hundred of his posts his pattern repeats itself ad nauseam.

The rights inability (like Paps BS premise that Buffett doesn't want his tax rates to increase, as HIS proposals would double his tax burden) to be honest is noted Bubba.

Socialists? Yep, just like the Founders who created a SOCIETY. You Klowns should try to understand what socialism ACTUALLY means Bubs

The right wing echo chamber sure has done a good job of having their reactionaries react with knew jerk to "socialists" lol