Skull Pilot

Diamond Member

- Nov 17, 2007

- 45,446

- 6,163

- 1,830

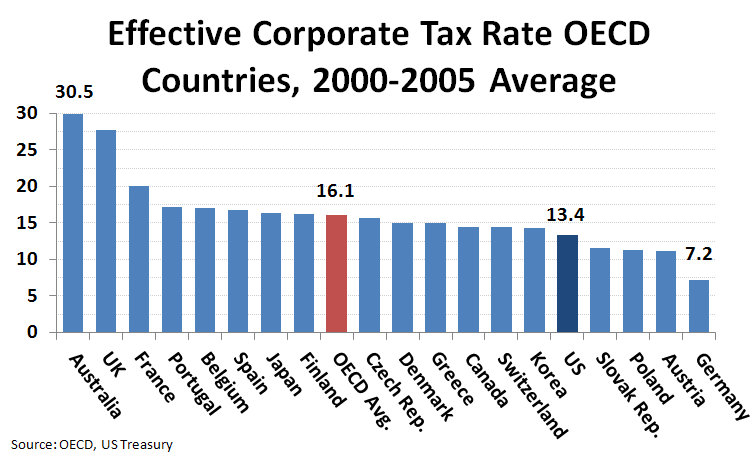

35% of children are hungry...The richest pay 28% in ALL taxes and fees, less than the middle class. You are clueless.Because the 0% people are starving and the 39% ACTUALLY PAY 17% AND ARE GETTING all THE NEW WEALTH?Taxes are the price of citizenry. The problem is Reaganist pander to the rich and giant corps, dupe. And wrecking the nonrich and the country DUH.Ah that old chestnut

Yes I think my money is my property I must want anarchy

Tell me if someone stole your money would you call the cops or would you just say oh well that money wasn't really my property?

If what you say is true then shouldn't everyone pay income taxes?

And why should some dollars get taxed at 39% and others at 0%

No one is starving in this country

And FYI people in the 39% bracket probably pay over 20% net income taxes and I can say that with some confidence

And no one is stopping you from increasing your net worth (wealth)

INCOME TAXES you thick fuck

And there is no way 35% of all kids are starving